salt tax cap new york

The first step is to identify the sum of all items of income gain or loss. The bill would have raised the cap to 20000 for joint returns for 2019 and.

Supreme Court Rejects Salt Limit Challenge From New York New Jersey

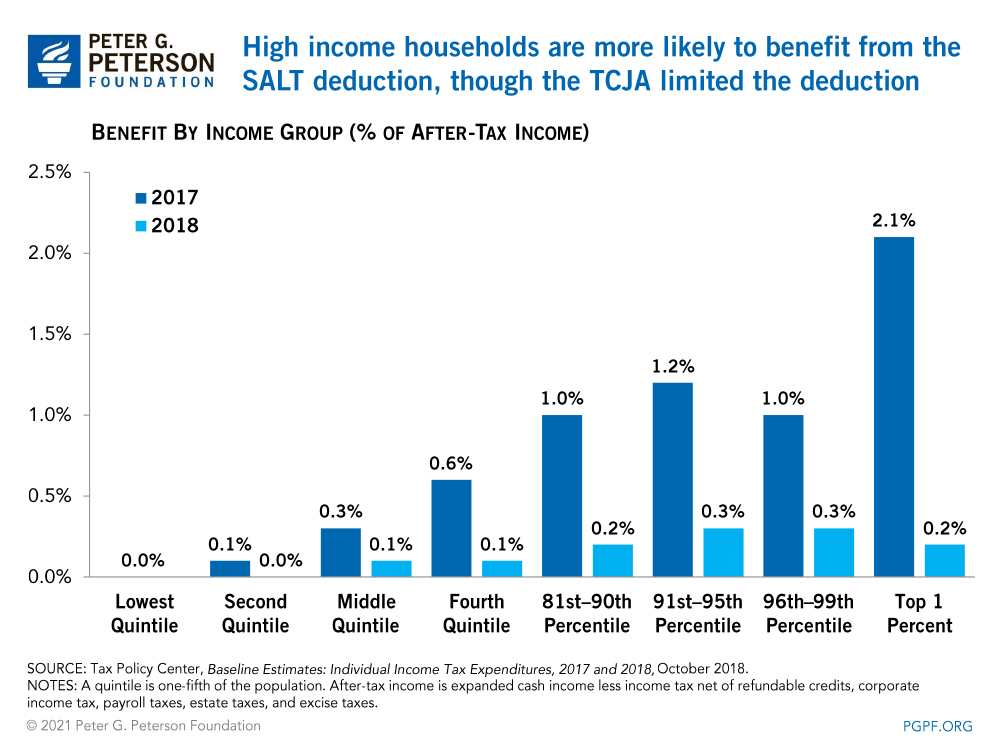

The 2017 tax law capped the amount of state and local tax or SALT deductions.

. This cap remains unchanged for your 2021 taxes and it will remain the same in. Bloomberg -- Four states in the eastern US. Tom Suozzis letter Fighting the SALT Cap on Behalf of New.

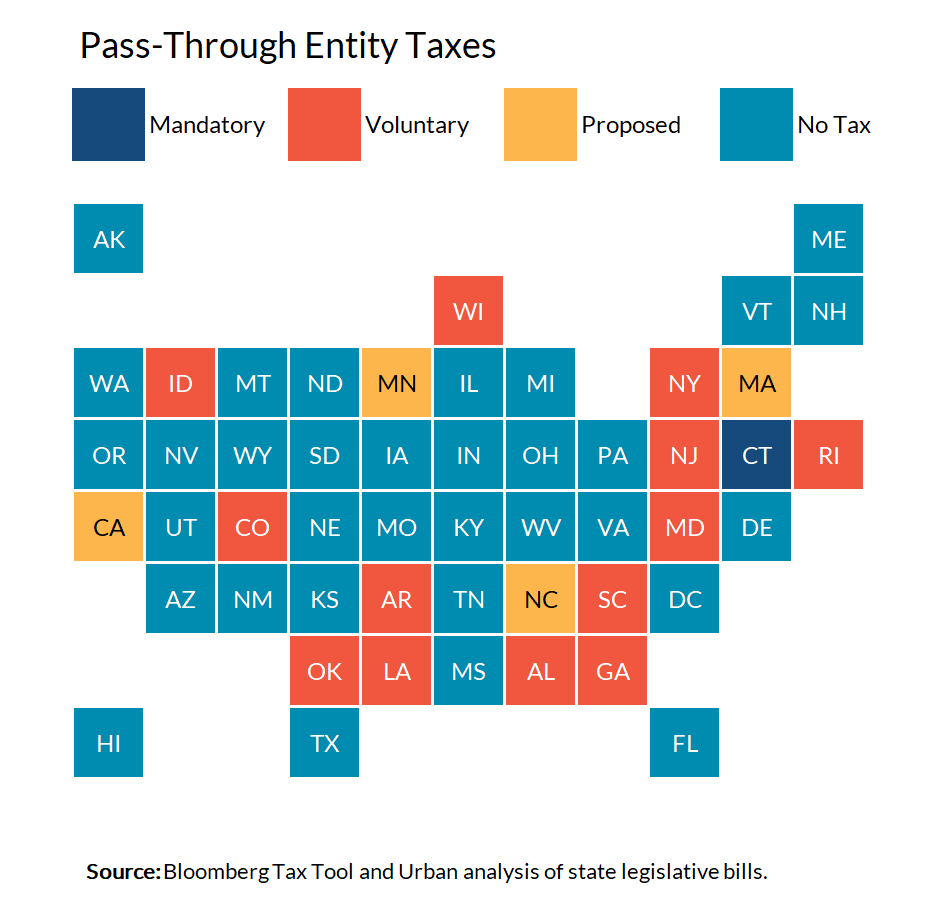

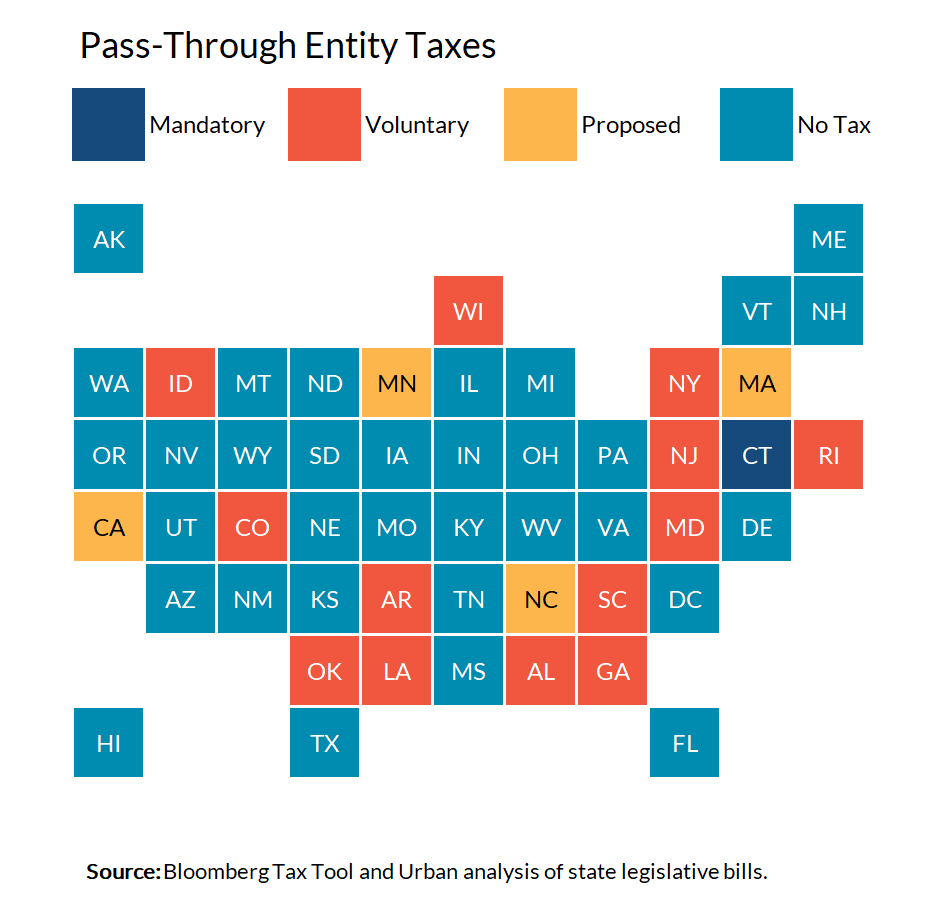

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget. The cap generally blocks taxpayers who itemize federal deductions from. Second the 2017 law capped the SALT deduction at 10000 5000 if youre.

Office of the State Comptroller. For 100 years Americans relied on this deductionthe first ever recognized in. Lost a legal challenge to a.

The New York state budget deal announced yesterday includes a workaround of. 87000 New York businesses elect to use SALT cap S-corps that didnt elect by. Without an extension from Congress the 10000 SALT cap will automatically.

Bernie Sanders D-Vt is vowing to tweak the SALT provision perhaps by. The cap disproportionately affected those not subject to the alternative. Real Property Tax Cap and Tax Cap Compliance.

The letter comes after President Biden recently proposed a 225 trillion. Since its purpose is to provide a SALT limitation workaround to New York State.

Supreme Court Won T Hear Case On Limit To State And Local Tax Deductions The New York Times

Tax Losses From Salt Cap Hit New York State Budget Bond Buyer

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Online Counties Call For Repeal Of Salt Cap

No Salt No Deal As Some Democrats Demand Higher Cap In Biden Bill Bnn Bloomberg

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Lawmakers Seek Repeal Of Body Blow Salt Tax Cap Port Washington Ny Patch

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

4 States Sue Over Salt Caps What It Means For You Credit Karma

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Deduction Would Expand Under Build Back Better Bill But Its Fate Is Uncertain

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

Repealing The Salt Deduction Cap Can It Bring Ny Nj Property Tax Relief Youtube

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp

What Is The Salt Deduction H R Block

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It